What happens to your money when you die?

October 15, 2023 | TS Prosperity Group

Truth Bomb: Everybody dies. But what happens to your hard-earned money and beloved assets left behind? When an individual dies, their property and assets get turned over to somebody (and in rare cases, to the State), but how? There are two ways assets can transfer: 1) through a trust or 2) through probate.

We’ve answered a few top questions about the probate rocess. The following provides clarity surrounding this mystery and gives some high-level guidance that may potentially lessen the burden of probate. At the end of the day, talk to your financial advisor, attorney, and tax professional about additional questions you may have.

Probate process questions:

What is probate?

Probate is the legal process, usually within a State court, used to distribute a deceased person’s assets. If the decedent left a will behind, this process includes authenticating the will.

Fast Fact: A will is the legal document that specifies how assets and property are to be distributed after death.

If there is no will for a person’s estate (meaning the estate is “intestate”) then probate can become even more complex and lengthy since there is no documentation that spells out a person’s final wishes to distribute his or her assets. In these cases, the court will determine the decedent’s asset distribution according to state law.

How does probate work?

Probate is a fairly costly and lengthy process, and it all begins when an individual passes away.

Step 1: File a petition with probate court

The first step is notification of an individual’s death by submitting a copy of the death certificate and filing a petition with the court to begin the probate proceedings. This is done in the state where the decedent lived at the time of death.

If a will was written, the will is filed with the court and the court validates the will. Once the will has been deemed valid by the court, the judge will formally appoint the named personal representative as the executor of the estate.

If a will was not written, then it is up to the judge to appoint someone as the Personal Representative as the Executor of the estate.

Fast Fact: A personal representative can be either an individual (such as a family member or trusted friend) or an institution that has the authority to administrate in this capacity (such as TS Bank or an independent trust company).

Step 2: Notify relevant parties

Beneficiaries are the obvious relevant parties to be notified, but if there is no will, figuring out and finding these individuals may be a difficult and time-consuming task.

Creditors must also be notified as monies from the estate must be used to satisfy any outstanding debts the decedent may have left behind. Determining and tracking creditors down poses a different challenge, regardless of whether a will is present. To start, a legal notice must be published in order to provide a public notice to creditors that may have a claim against the estate, and, as a general rule of thumb, a waiting period of no less than four months should occur before distributions are made to provide ample time for any creditors to file against the estate.

Fast Fact: Any estate that goes through probate proceedings is public—this includes value and listings of debts and assets.

Step 3: Inventory assets

This can be the largest and most daunting task a personal representative, or executor of the estate, must handle. Inventorying assets include locating and valuing all bank accounts, retirement and investment accounts, insurance policies, real estate owned, motor and recreational vehicles, and personal effects (that includes everything from the bronzed baby booties in the attic to the pile of shoes in the closet) effective at the time of the decedent’s passing.

The total combined value of all assets is then used to estimate the value of the estate.

Fast Fact: A professional appraiser or estate sale company may be helpful for inventorying and calculating the value of real estate, vehicles, and personal items. They have the knowledge and expertise to accurately assess a value.

Step 4: Pay outstanding bills & collect monies owed

At this point, the personal representative has identified creditor, with whom the decedent has outstanding debts and has inventoried (and possibly liquidated) their assets. In some cases, the personal representative will need to also collect on monies owed to the estate, such as, life insurance proceeds.

Once those items have been buttoned up, it’s time for the personal representative to pay any outstanding bills. These items can include: any medical and funeral expenses, taxes (final income taxes of the decedent and estate or inheritance taxes), and aggregated court costs and attorney fees accumulated during probate.

Fast Fact: The personal representative needs to ensure extra care is taken during this step as debtors may try to recoup any unpaid debts from beneficiaries in the future.

Step 5: Distribute remaining funds to beneficiaries

Finally, the named beneficiaries (whether via will or by determination of the court) are able to collect the remaining assets. If any real property is to be transferred, the personal representative is responsible for transferring any deeds or titles to the appropriate beneficiary.

Step 6: Close the estate

Once the personal representative has completed the entire probate process, they are able to file a final accounting with the court and the estate can be closed out.

Fast Fact: Many states allow a personal representative to collect a reasonable (2%-5% of the full estate value) compensation. This compensation is typically paid out in step 4, as an outstanding bill of the estate, taking precedence over beneficiaries receiving their share of the estate.

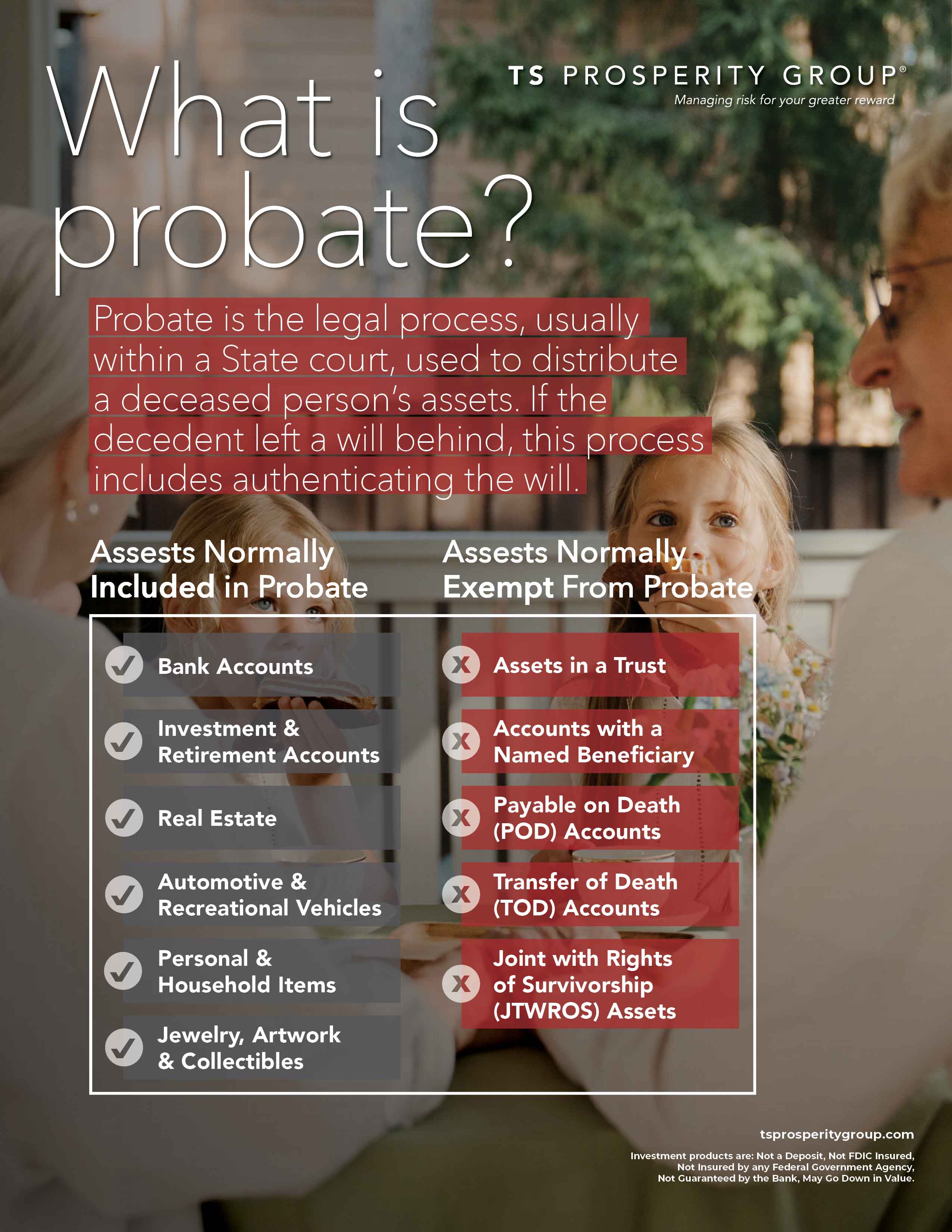

Are all assets included in probate?

Not all assets are included in probate and knowing what assets are and are not included can help with your estate planning in advance of probate or of drafting a trust. The following list, while not all-inclusive, can be a guideline for the types of assets that go through probate and the assets that are probate exempt

How much does probate cost?

Overall, the cost of probate will vary from state to state, but there are a few costs that could be incurred no matter what state the decedent lived in.

Filing fees & court costs

From the initial filing of the petition to begin probate proceedings to the filing of the final accounting, individual counties and states have filing fees and court costs associated with probate.

Attorney fees

While not all states will require a probate attorney, it’s a good practice to have legal representation of the estate. Probate attorneys may charge hourly, a flat rate, or a fee based on a percentage of the full estate value.

Probate bond

If the executor or personal representative is an individual, the court may request (and in some states, require) a probate bond. This is a level of protection for the beneficiaries of the estate to ensure the individual acting in that executor or personal representative role performs their duties in good faith of the estate.

Miscellaneous fees

Depending upon the type and quantity of assets, there are other fees to tack onto those probate costs. Those fees could include: appraisal and realtor fees for real estate, appraisal or estate sale fees for personal property, notary and postage fees for legal documents, business valuation fees if the decedent was owner or part-owner of a business at the time of death, etc.

Is there a way to avoid probate?

Thankfully, there are different ways to avoid probate and the three most popular ways to avoid probate include:

Create a trust

Creating a trust not only helps avoid probate by fluidly appointing a trustee to continue carrying out the trust’s directive and distribute assets, but it also keeps the estate completely private. Remember, probate proceedings are entirely public (recall the notices that must be filed in “Step 2” of the probate process), so keeping knowledge of personal and family assets private may be a priority for certain individuals and families. Creating a trust ticks both boxes: It avoids probate and keeps assets private.

Appoint a named beneficiary on assets and/or create payable on death (P.O.D.) or transfer on death (T.O.D.) accounts

It’s a really good practice to take an annual or biennial inventory of your assets and accounts and audit your named beneficiaries. Ensure that your life insurance policies, any annuity policies, employer-sponsored retirement plans, and IRA’s have a named beneficiary. When you name a beneficiary on those assets, upon death, proceeds go directly to that individual without going through probate.

Similarly, bank accounts, investment accounts, stock and bond accounts, real estate and vehicles (double-check on your state laws for real estate and vehicles) can be titled with a P.O.D. or T.O.D., which will then do precisely as its title states and either pay or transfer to the named beneficiary directly upon death, bypassing probate requirements.

Title property jointly with rights of survivorship (JTWROS)

Real estate, motor or recreational vehicles, some bank or brokerage accounts, and even personal property can be titled as Joint Tenants with Rights of Survivorship (JTWROS). This not only provides an equal right to the account’s assets or value of the property, but they are automatically granted survivorship rights when the joint owner passes away. This not only avoids probate, but it also provides seamless continuity between the joint tenants.

Fast Fact: Some assets may be better to inherit and utilize the stepped-up basis tax code versus the carryover basis. The stepped-up basis is an asset’s market value gets “stepped-up” to the market value at the time of the decedent’s death. This can alleviate capital gains taxes when the asset is sold.

It is important to keep in mind, since each person has a unique situation, there is no true “one size fits all” option to prevent probate from occurring. The best way to strategize for estate planning is to utilize the Prosperity Trifecta (a financial planner, an estate planning attorney, and a tax professional).

A community-banking leader, TS Bank is proud to have the largest state-chartered C-Corp trust department in western Iowa, TS Prosperity Group. Our team of knowledgeable experts are available to help build a Prosperity Trifecta for individuals residing anywhere in the domestic United States. We can review an existing estate plan and help fill in any gaps or offer additional wealth advisory, tax planning and fiduciary services. Call us at 844.487.3115 or schedule an appointment now.

Disclaimer: This article is for informational purposes only and should not replace legal, financial, or tax advice from your attorney, financial planner, or tax professional. Before implementing any of these strategies, consult your Prosperity Trifecta—if you don’t have one, we’re happy to create one with you.

TS Prosperity Group’s purpose is to IGNITE PROSPERITY® in our communities by preserving generational wealth. Unique circumstances and risks exist within each family. Utilizing our fiduciary approach to investment management, we help identify those risks and create a solution-based prosperity plan to address them and support their family’s financial legacy.

Investment products offered by TS Prosperity Group are: Not a Deposit • Not FDIC Insured • Not Insured by any Federal Government Agency • Not Guaranteed by the Bank • May Go Down in Value.